Seizing Opportunity in a Kinked Yield Curve: Why Now Is the Time to Act?

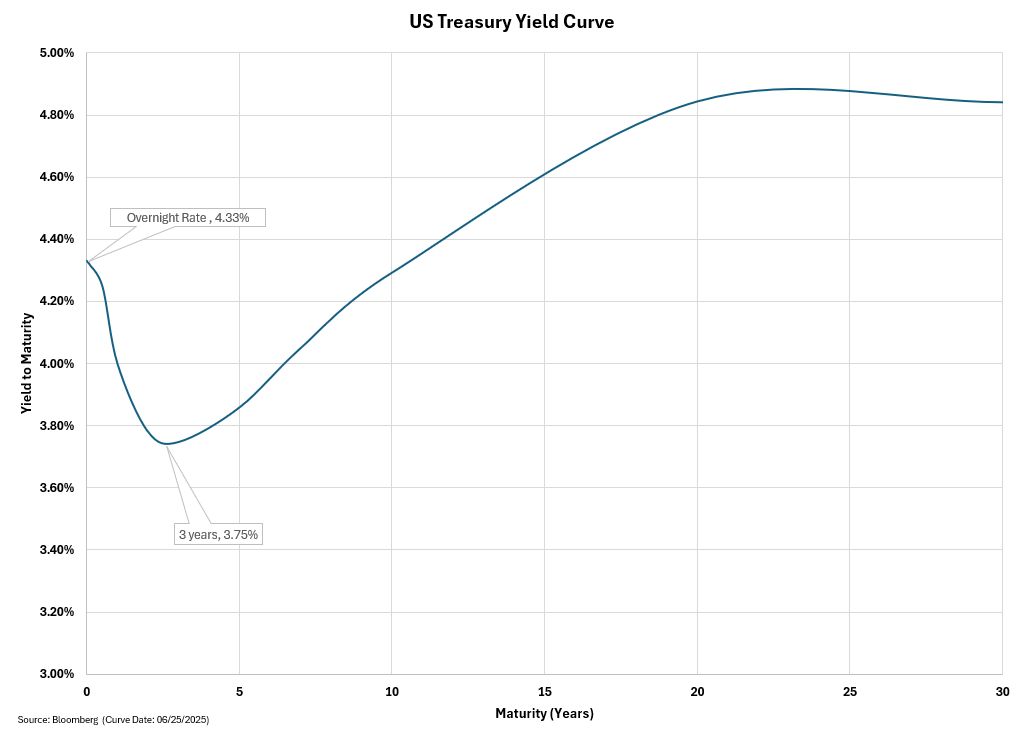

This isn’t your classic yield curve inversion—it’s a kink in the yield curve. And where most economic pundits see a structural red flag, smart business leaders are positioning for the future.

Yes, the Fed’s signaling two rate cuts before year-end; typically, a harbinger of coming economic softness. But long-end yields are pricing in something different—resurgent inflation, expansion, or both. At this point the market nor the economy seem to be cracking.

Look around

- Equities aren’t retreating—they’re making new highs.

- Labor markets aren’t cracking—they’re holding firm, with wages up 3.9% YoY.

- Consumers aren’t pulling back—they’re absorbing shocks and staying in the game.

This isn’t recessionary behavior. It looks like an economy coiled for growth.

And yet—one overhang remains: the passage of the “Big Beautiful Bill.” If it stalls, the rally may stall with it. But if it crosses the finish line, it could unlock fiscal tailwinds and supercharge risk asset pricing.

If you’re a business leader, this isn’t the moment to hunker down—it’s time to lean in. Those prepared to act with velocity will find capital not just available, but eager—at Bankers Edge we are advising our clients to:

- Reassess your capital stack—optimize for agility to take advantage of dislocation in valuations or supply chain resets.

- Line up dry powder—whether through credit, equity, or hybrids, now is the time to secure flexible capital at today’s terms, not tomorrow’s premiums.

- Position for bold moves—whether it’s tuck-ins, carve-outs, joint ventures, or infrastructure scale-ups, transactions executed in the next two quarters could define the decade.