Fed Rate Cuts: A Brief Window for Capital Raising

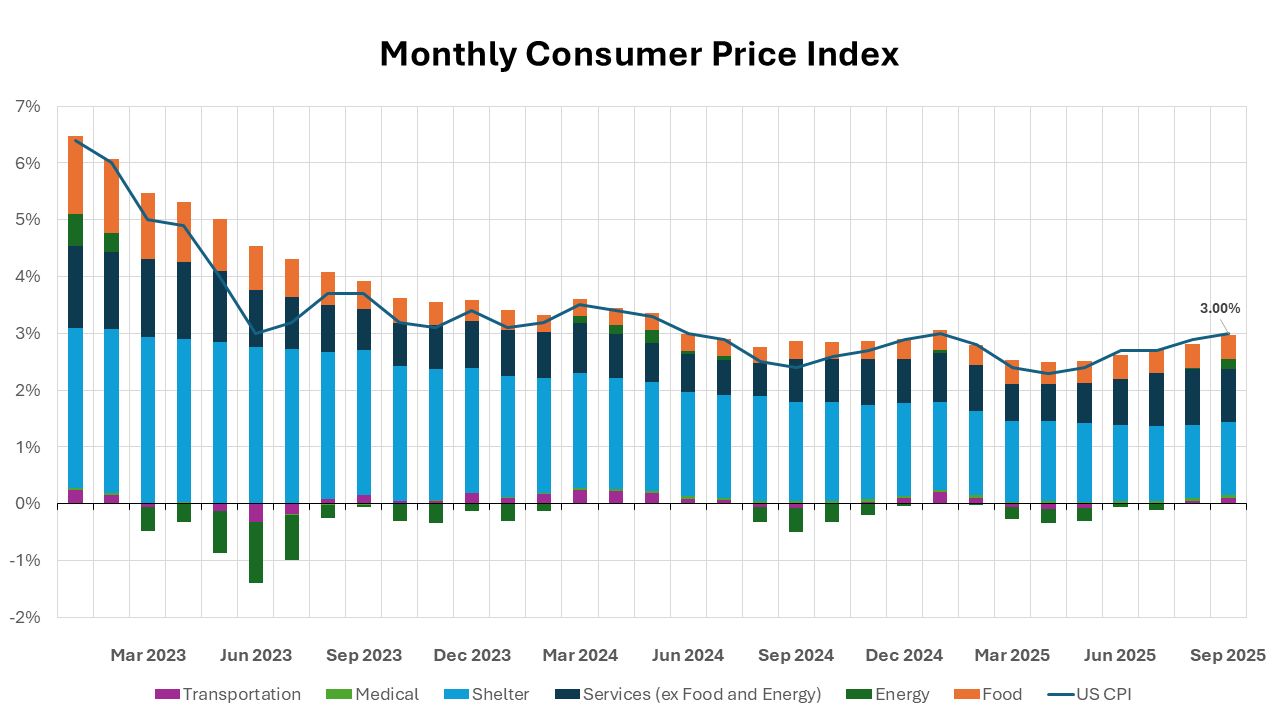

The Consumer Price Index (CPI) continues to run above the Federal Reserve’s 2% target—a sign that inflation remains a persistent challenge for policymakers and markets alike. Interest rate cuts, though they offer short-term relief, tend to make achieving that inflation target more difficult as lower borrowing costs generally stimulate growth and demand.

Recent data show encouraging signs: food, energy, transport, and medical inflation have started to cool, providing relief in key household spending areas. Yet, the core inflationary pressure currently stems from two sources:

- Shelter—A continued shortage of homes is driving up housing costs.

- Services—Wage growth in service sectors is keeping costs elevated.

Our outlook at Bankers Edge Advisory is that the Fed’s current easing cycle will be short-lived. As rate cuts reduce borrowing costs and fuel economic growth, this “golden-lock” environment for capital raising may only last a limited time before monetary conditions tighten again or inflation pressures resurface. The lesson is clear: companies in need of capital should act quickly to seize this rare opportunity. As the old saying goes, “Make hay while the sun shines.”

For more detailed insights on the evolving rate environment and its impact on credit markets, view Bankers Edge Advisory’s latest September Credit Market Update.