Recent headlines suggest that the U.S. consumer is showing signs of strain, but the broader reality tells a much different story. Beneath the surface-level noise, the fundamentals remain strong:

- Employment levels are holding steady.

- Wages continue to rise, fueling purchasing power.

- Consumer delinquency rates are moderating.

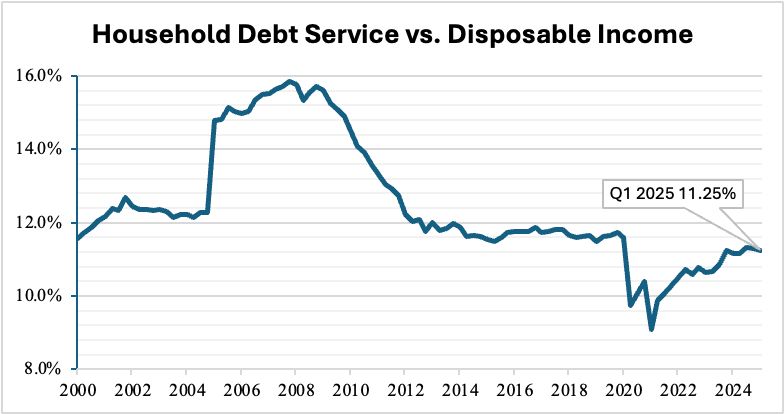

- Household debt service stands at just 11.25% of disposable income, a historically healthy level.

As Mark Twain reminded us, “The rumors of my death are greatly overstated.” Today, the same holds true for the American consumer.

What This Means for Investors

While media narratives may cause some investors to step back, disciplined capital providers see this environment as an opportunity. The consumer discretionary sector remains resilient, supported by stable household economics and long-term demand trends. Those who take a contrarian, fundamentals-first approach often stand to benefit the most.

How Bankers Edge Helps

At Bankers Edge, we specialize in raising capital for companies in the retail and consumer-focused sectors. We understand the nuances of consumer sentiment versus consumer reality—and we partner with management teams to present opportunities that resonate with investors who recognize long-term value.

Whether you are:

- A consumer brand positioning for expansion,

- A retail company seeking growth capital, or

- An operator navigating the current market environment,

we connect you with investors who understand and support the enduring strength of the American consumer.

Let’s Talk

If your company is exploring capital raising opportunities in the consumer space, our team is here to help you engage with the right partners. Together, we’ll turn market uncertainty into opportunity.